Investing can seem daunting, especially when you’re just starting out, but with the right knowledge, you can turn it into one of the most rewarding ways to grow your wealth. Whether you’re looking to build your portfolio, learn about real estate, or dive into the stock market, there are many books that provide valuable insights into the world of investing. If you’re searching for guidance, exploring the top 10 best investing books can help you gain the knowledge and strategies needed to make informed financial decisions.

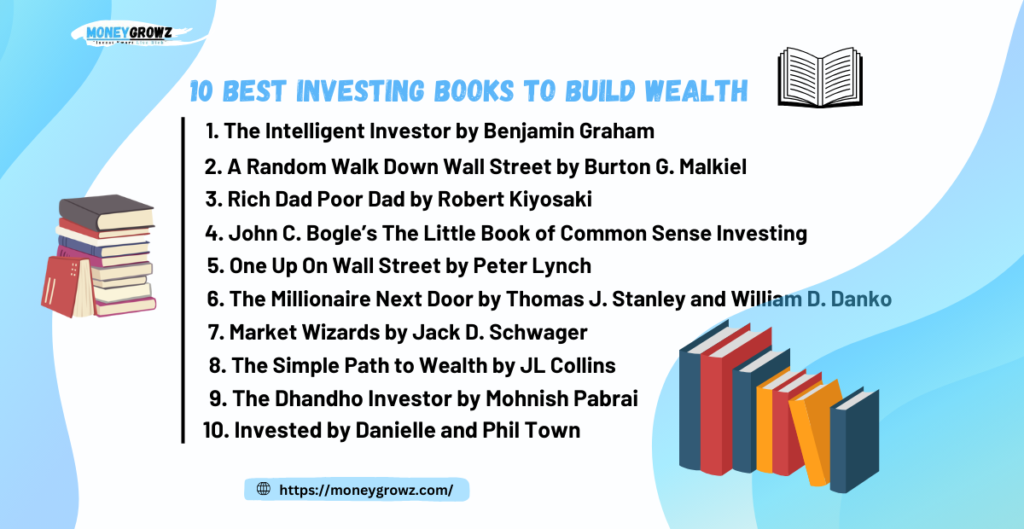

In this guide, we’ve compiled a list of the top 10 Best investing books for 2025. These books cater to beginners, intermediate investors, and seasoned experts, providing practical advice and strategies for making smarter financial decisions.

1. The Intelligent Investor by Benjamin Graham

Why You Must Read It: The Intelligent Investor, penned by the renowned Benjamin Graham, is frequently regarded as the “bible” of value investing.The book teaches principles that emphasize long-term investing, buying undervalued stocks, and minimizing risk. Warren Buffett himself credits this book with shaping his investing philosophy.

Key Insights:

-

- Understanding stock and bond analysis

-

- Protecting against market volatility

-

- The power of long-term investing

Buy The Intelligent Investor on Amazon

2. A Random Walk Down Wall Street by Burton G. Malkiel

Why You Should Read It: This book introduces the concept of the efficient market hypothesis (EMH), which states that all stocks are fairly priced based on available information. Malkiel offers a detailed look at different asset classes, such as stocks, bonds, and real estate, and why a diversified portfolio is the best approach to investing.

Key Insights:

-

- Stock market trends and how to analyze them

-

- Benefits of diversification

-

- Why beating the market is challenging

Buy A Random Walk Down Wall Street on Amazon

3. Rich Dad Poor Dad by Robert Kiyosaki

Why It’s Worth Reading: Rich Dad Poor Dad highlights the importance of financial education and explains the difference between assets and liabilities. Robert Kiyosaki offers advice on how to build wealth through real estate, investment strategies, and entrepreneurship, making it a perfect read for anyone looking to achieve financial independence .

Key Insights:

-

- The difference between assets and liabilities

-

- How financial literacy shapes wealth-building

-

- The importance of investing in real estate and business

Buy Rich Dad Poor Dad on Amazon

4. John C. Bogle’s The Little Book of Common Sense Investing

Why It’s Great: John C. Bogle, the creator of Vanguard Group, supports index funds as a low-cost, passive investing strategy. His book emphasizes the importance of keeping investing simple and avoiding high fees that can eat into your returns.

Key Insights:

-

- Why index funds perform better than the majority of actively managed funds

-

- The importance of minimizing fees

-

- Creating a varied investment portfolio utilizing index funds.

Buy The Little Book of Common Sense Investing on Amazon

5. One Up On Wall Street by Peter Lynch

Why You Should Read It: In One Up On Wall Street, Peter Lynch shares the secrets behind his successful investment strategies. He explains how to pick stocks based on your personal knowledge and emphasizes the value of doing your own research to find promising investment opportunities.

Key Insights:

-

- How to pick stocks with growth potential

-

- The importance of independent research

-

- Understanding different types of stocks

Buy One Up On Wall Street on Amazon

6. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

Why It’s Essential: This book provides valuable insights into how wealthy individuals accumulate wealth through smart financial habits rather than extravagant lifestyles. The Millionaire Next Door highlights the importance of living below your means and focusing on building long-term wealth.

Key Insights:

-

- How wealthy people manage their money

-

- The role of frugality and smart saving

-

- The power of investing over time

Buy The Millionaire Next Door on Amazon

7. Market Wizards by Jack D. Schwager

Why It’s Essential: Market Wizards is a series of interviews with some of the most successful traders in the world. These professionals share their unique strategies,risk management and insights into how they achieved market success, offering practical advice for anyone interested in trading.

Key Insights:

-

- Strategies of top traders and investors

-

- Risk management techniques

-

- Building a disciplined trading mindset

8. The Simple Path to Wealth by JL Collins

Why You Should Read It: JL Collins offers a simple approach to achieving financial independence and retiring early (FIRE) through smart investing. The book focuses on low-cost index funds, a straightforward investment strategy that has become popular among long-term investors.

Key Insights:

-

- Utilizing index funds for the purpose of long-term wealth accumulation.

-

- A simple approach to creating a low-cost portfolio.

-

- Steps to achieving financial independence.

Buy The Simple Path to Wealth on Amazon

9. The Dhandho Investor by Mohnish Pabrai

Why You Should Read It: Mohnish Pabrai shares his approach to value investing, which focuses on finding high-potential businesses with little downside risk. This book emphasizes the importance of patience, discipline, and intelligent decision-making when investing in stocks.

Key Insights:

-

- The principles of value investing

-

- How to find undervalued companies with high upside potential

-

- Minimizing risk while maximizing returns

Buy The Dhandho Investor on Amazon

10. Invested by Danielle and Phil Town

Why It’s Worth Reading: Invested is a guide to value investing from the perspective of father-daughter duo Phil and Danielle Town. This book simplifies the process of stock analysis and helps readers develop a personalized investing strategy based on value investing principles.

SEO Keywords: value investing, stock analysis, investing strategy, Phil Town

Key Insights:

-

- How to analyze stocks using value investing principles

-

- Building a long-term investing strategy

-

- The significance of funding businesses with solid foundations

Conclusion: Start Your Wealth-Building Journey Today

If you’re serious about building wealth through investing, these 10 books offer essential knowledge, strategies, and techniques to help you succeed. Whether you’re a beginner or an experienced investor, the right mindset and strategy are key to achieving your financial goals.

Start reading these best investing books today and begin building the wealth you deserve.

Disclaimer:

This page contains affiliate links, which means I may earn a small commission if you make a purchase through one of these links at no additional cost to you. Please note that I only recommend products or services that I genuinely believe will add value to my readers. Your support helps me keep providing helpful content. Thank you for your support!

Perfect work you have done, this web site is really cool with fantastic information.

Attractive element of content. I just stumbled upon your site and in accession capital to say that I acquire in fact loved account your weblog posts. Any way I will be subscribing for your augment and even I success you get admission to consistently rapidly.

Appreciation to my father who stated to me on the topic of this blog, this weblog

is genuinely amazing.